If you already have a property portfolio or are considering building one, should you do this in your name or within a company. Also, if you have a portfolio, is it worth transferring it into a company rather than holding it in your own name?

Professional and amateur landlords are finding themselves entering stormy waters. Recent press headlines tell stories of long time landlords with sizable property portfolios considering calling it a day. Why?

Enter Section 24. This has gradually been phased in since 2015, but was in full force by 2020. Section 24 of the Finance Act 2015 restricts mortgage interest relief at whatever tax bracket you found yourself in – say 40%, to the basic rate of 20%. This means that for some BTL landlords, their tax bills have doubled. For some, in higher tax brackets, it’s significantly more.

While Section 24 reduces tax relief on mortgage interest payments, it still allows a raft of other ’operational’ expenses to be set against profits before tax.

Furthermore, recent changes in Section 21 laws mean that landlords can no longer simply evict tenants for ‘no-fault’. This makes renting much more risky.

Naturally, these changes are making many landlords think twice about either continuing with their portfolios or entering the market. However, for those more hardy landlords or still aspiring investors still looking to build a property empire, one incorporating all the legal challenges currently surfacing, this may represent a great opportunity to pick up rentals other landlords are looking to dispose of. The question arises – should a property portfolio be held in an individual’s name or within a corporate entity?

Should I transfer my rental property portfolio in to a company?

Why does this question arise? Quite simply – because of personal tax issues and potential benefits of lower corporation tax.

Landlords who run a property rental business, perhaps built through buy-to-let mortgage schemes, report income from their lettings business in their own personal tax return – the SA100, more specifically the SA105 Supplementary pages. In other words, a landlord could find themselves in a higher tax bracket – 40% or 45%.

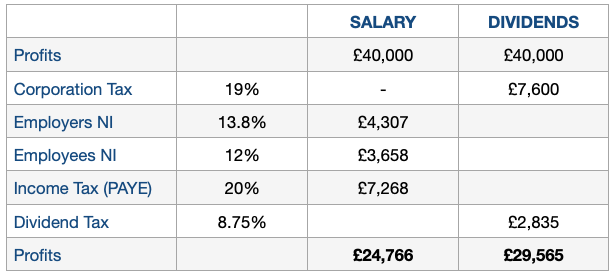

Holding property in a company means paying corporation tax on profits, currently at 19%, rising to 25% in 2023, significantly better that paying 40% or 45%. If a director then takes a dividend to access the profits, they will likely see a sizable positive difference compared to the alternative of a personal tax approach. This is because of the savings made from not paying regular income tax and national insurance.

The director is around £4,800 better off through dividend taking – currently.

Where property portfolios and existing landlords are concerned there is a rather large ‘BUT’ in regard to whether it’s actually worth transferring property into a company to realise gains through paying corporation tax and dividends. This is another key question that gets asked.

Is it worthwhile transferring my property portfolio into a company?

The answer to this question is ‘it depends’. In this case it rather depends on how many properties you have in your portfolio.

To be able to transfer a property into a company, you are essentially selling what you own to the company entity. What does this mean?

- Transferring the property into a company means that you will no longer own the property – the company will. Your ownership is indirect, through shares in your company. If you own 100% of the company, then you own 100% of the shares and therefore the shares in the properties.Problems may arise when trying to do this though, particularly if the properties are mortgaged, such as through a ‘buy-to-let’ (BLT) scheme. The problem comes about because banks won’t allow you to mortgage an asset you don’t personally own. If you do have properties mortgaged, in all likelihood, you’ll have to pay-off the original ‘personal’ mortgages and re-mortgage through a commercial mortgage scheme. Naturally, interest rates will likely be high for commercial loans. If you own the properties outright, this isn’t an issue.

- When you ‘sell’ the property(s) to your company, you’ll likely be liable for capital gains tax (CGT) on any profits you make in the sale. If you’ve had the properties for a while, this may be significant. Naturally, HMRC expects you to sell the property at a realistic market rate, so you can’t step around this by selling the property to your company ‘on the cheap’.It may be possible for you to ‘defer’ the CGT payment. If you run your BLT as a business, as opposed to ‘a source of disposable income’, you may be able to receive ‘Incorporation Relief’. This is more likely to apply to a landlord with more than a few properties though. Incorporation relief allows you to defer the CGT payment until a later date when the shares you receive in return for the properties are divested of. At the time of divesting, you’ll be liable for the CGT you would have paid originally.

- Another consideration to make before shifting your properties into a company is the fact that selling them to your company means your company will have to pay stamp duty too. If for instance, under normal circumstances, the property you are selling sells for £350K, you’ll need to pay around £18,000 in Stamp Duty (SDLT), as you’ll own more than one residential property. If you have a number of such properties to transfer, you may be able to claim ‘multiple dwellings relief’. The benefit in this is that rather than apply SDLT to each property transaction based on the price paid, the purchase of multiple properties is considered as a single transaction. So, rather than calculating SDLT on the total price of all properties purchased, SDLT is calculated based on the average price paid for each property. This is likely to reduce overall SDLT payable.

- There are other costs associated with running a property business, that as an individual, you’ll not pay. You’ll need to use an accountant like TaxAgility to assist with your business tax returns and other statutory requirements. On a monthly basis, you’ll likely need your bookkeeping done so as to keep track of rent payments, and the general costs associated with running a residential property portfolio. All this adds up.

- Please note: While the above implications for CGT and stamp duty apply in most circumstances, mechanisms do exist where it is possible to legitimately avoid both capital gains tax and stamp duty. How this is achieved does depend on your unique circumstances and we would need to discuss this with your directly so that this could assessed and explained in detail.

Call us today on 020 8108 0090 to find out more.

In summary, transferring a property portfolio into a company is not a step that can be taken lightly. All the financial implications with moving a property portfolio into a company suggest that it’s wise to prepare a complete financial model showing before and after projections of any likely cost savings. Remember that any benefit that arises will arise from the longer term tax savings through corporation tax and dividend tax, if you take the profits in that way. When considering the transfer costs identified above, reaching breakeven may take a few years. The scale of your business though, may still make this an attractive proposition.

Moving a property portfolio into a company isn’t straightforward for many portfolio owning landlords, there’s a lot to consider and numbers to work through. Starting a property portfolio though using a company, is a different matter, as all of the costs associated with transferring properties won’t exist, making the decision more attractive to make.

TaxAgility can advise and assist landlords with property portfolios make the right tax choices

Whatever circumstances you find yourself in, we’d like to reassure you that TaxAgility are specialists in assisting landlords and ‘High Net Worth Individuals’ (HNWI) with personal property portfolios, to make the best decisions. We’ll walk through the thinking and the calculations with you transparently, so you can decide if moving a property portfolio into a company is the right thing to do.

No matter what you decide, we’ll be here to help you manage your portfolio in the most tax efficient manner based on your unique circumstances.

Call us today on 020 8108 0090 and find out how we may be able to significantly improve the tax outlook for property letting business.

Please note: The information contained in this article should not be treated as either tax advice or investment advice, it is for information only. You should always contact a tax or investment professional who can assess your personal circumstances before making important financial decisions.