Tapered pensions annual allowance - what is it and does it affect me?

Each year individuals can make a tax free contribution to their pension pot. Presently, for most regular tax payers, this is a maximum of £40K per year. However, the closer your income gets to £240,000 per annum, the closer the attention you’ll need to pay, as the amount you can contribute in each year starts to ‘taper off’, hence the term “pensions tapering”.

Every year, we like to make sure that our clients fully maximise their opportunity to contribute to their pension pot in a tax efficient manner. With recent changes in the pensions tapering rules and the lowering of the minimum allowance, we thought we would review the current state of affairs in regard to tax efficient pensions contributions and pensions allowance tapering.

What is the pension annual allowance?

This is simply the maximum amount that you are allowed to contribute to your pension pot and still receive tax relief.

Currently, this stands at £40K. However, if you are a higher tax bracket earner, this may be significantly reduced through the tapering of your annual pension contribution allowance, depending on your level of income within the tax year in question.

Does tapered pensions annual allowance apply to me?

We should point out immediately that if your net income is less than £200,000 and you’re unlikely to break this barrier through the addition of other sources of income, then it is highly unlikely you will be affected by tapering of the annual pensions allowance. Typically this only affects high earners and high net worth individuals (HNWI).

That said, if your regular income is significantly less than this, but for one reason or another find that you have an unexpected gain, perhaps through the sale of a second home, maturity of an insurance policy, you may find that tapering for the year the event occurs applies to you. This is why it is critical that you speak to a specialist accountant like TaxAgility, prior to any such event, so we can assess your individual situation and advise on a strategy to mitigate any undesirable and legally avoidable tax liabilities.

I am close to the £200K income level, how do I calculate a tapered allowance?

To correctly ascertain if you are impacted by pensions allowance tapering, there are four terms that need to be understood, so as to gain an accurate assessment of your actual income any payments made to pensions plans is concerned.

Net Income in the tax year in question. To be clear here, ‘net’ doesn’t simply mean ‘after tax’. In this case net means all taxable income less deductions. The deductions we are interested in here are those related to member’s contributions paid into any UK registered pension schemes. Add up any personal contributions made to employer pensions schemes - those that fall under a ‘net pay’ agreement. The add up any contributions you may have made personally through a ‘relief-at-source’ arrangement - these schemes typically accept pensions payments made net of tax and then within the pensions scheme are grossed up to the basic rate of tax. Once you have done this deduct these amounts from your total income, including any taxable overseas income (worldwide income).

Net Income in the tax year in question. To be clear here, ‘net’ doesn’t simply mean ‘after tax’. In this case net means all taxable income less deductions. The deductions we are interested in here are those related to member’s contributions paid into any UK registered pension schemes. Add up any personal contributions made to employer pensions schemes - those that fall under a ‘net pay’ agreement. The add up any contributions you may have made personally through a ‘relief-at-source’ arrangement - these schemes typically accept pensions payments made net of tax and then within the pensions scheme are grossed up to the basic rate of tax. Once you have done this deduct these amounts from your total income, including any taxable overseas income (worldwide income).

Threshold income. This is the income you have just calculated - i.e. net of any pension payments. If your threshold income is over £200,000, you will be subject to pensions tapering.

Adjusted income. This is the total figure for your income including your pension payments. If your adjusted income is more than £240,000, you will be subject to pensions tapering.

What is the difference between threshold income and adjusted income?

The basic difference represents the £40,000 pensions contribution allowance. If your threshold income starts to exceed £200,000, your contribution allowance will naturally reduce. For example, If you receive £210,000 in income, your allowance will reduce to £30,000.

How is pensions allowance tapering applied when I exceed an adjusted income of £240,000?

Once you exceed the adjusted income threshold of £240,000, a tapered allowance formula kicks in. For every £2 your adjusted income exceeds £240,000, your annual allowance for the year in question, reduces by £1.

Here are some examples to show how this works in practice.

Scenario 1 - a reduced allowance

Bob has calculated his adjusted income as £290,000 for the tax year concerned. This exceeds the adjusted income threshold by £50,000. Applying the 2 for 1 rule, his pension contribution allowance therefore is reduced by £25,000, i.e £40,000 standard allowance minus the £25,000, leaving a £15,000 tapered allowance.

Scenario 2 - minimum allowance tapering

Alice had a good year and earned £350,000. This exceeds the adjusted income threshold by £110,000. Her allowance should therefore be reduced by £55,000, more than that available. In this case the government introduced a minimum annual allowance that the tapering would allow - this is £4,000. Therefore Alice’s new annual allowance is just £4,000, not nil.

Scenario 3 - over payment and carry forward entitlement

In scenario 2, Alice had benefited from pension contributions of £40,000. Her actual allowance had been tapered to £4,000. Therefore, Alice had an excess of £36,000. Ordinarily, this amount would be added to Alice’s taxable income (net of pensions payments made by her personally). As such Alice would have to pay income tax on this amount at the prevailing tax rate for her situation. This should be declared on her Self Assessment return.

However, this was an extraordinary year for Alice. In previous years, she did not make full use of her pensions allowance. The government allows you to carry forward up to three years of entitlement up to a maximum of 100% of her earnings. As Alice has more than £36,000 in unused allowances, this will offset any income tax liability.

Why high income earners and high net worth individuals should consider TaxAgility

It can be very easy to forget the complicated issues surrounding tax implications and pensions payments. There’s nothing worse than having a great year only to find out that the tax man is hammering on the door for additional payments or even a fine because you mis-reported your actual earnings on your self assessment form.

The Tax specialists at TaxAgility work with our high income / net worth clients to ensure that they have a clear view of potential pitfalls associated with issues like pensions payments and allowances. We will advise you of any possible issues that may arise because you’ve had a significant pay rise, moved into a higher paying job, the sale of stocks and shares or other such taxable event.

In short, our tax planning services can help minimise your tax liabilities and allow you to plan and mitigate future events that may have a significant impact.

Contact TaxAgility today on 020 8108 0090 and let us help you maximise your pensions contributions!

Disclaimer. This article is for information purposes only and should not be considered tax advice under any circumstances, as individual circumstances are unique. You should always contact a tax professional if you think the scenarios described in the article may relate to you. This way we can assess your personal situation and provide accurate tax advice.

Trust Registration Service - Rules extension and deadline

Changes in trust registration requirements - act now!

Did you know that you have until September 1st 2022 to register a trust with the Government’s Trust registration Service (TRS), even if you previously didn’t have to?

Until recently, only thrusts that had a UK tax liability, had to register. This included off-shore trusts, but where they still had a UK tax liability. Now, all Express Trusts need to be registered.

Recent changes in Trust Registration Requirements

The new requirements to register a trust were introduced in 2020. Those trusts created on or before October 6 2020, have until September 1 2022 to register or be faced with a fixed penalty fine of £100 or up to 5% of any tax due (or £300, whichever is greater).

Trusts created after this date must be registered within 90 days of creation.

It is estimated that because of this change, there may be around one million trusts in the UK that are still to be registered before the September 1st deadline.

What trusts now need to be registered?

The Government instructs that the the following types of trust now need to register:

- All UK express trusts — unless they are specifically excluded

- Non-UK express trusts, like trusts that:

- acquire land or property in the UK

- have at least one trustee resident in the UK and enter into a ‘business relationship’ within the UK

By way of example, trusts that now require registration include those where:

1. A trust holds an offshore or onshore investment that was set up by a financial advisor. Most commonly these include:

- discounted gift trusts

- loan trusts

- gift and loan trusts

2. Property is held and a beneficiary exists but where there was no taxable income or capital gains and therefore no need, up to now, to register with HMRC.

3. Trusts that hold shares in a private company. This includes:

- a trading company,

- a family investment company (FIC)

- a personal investment company (PIC)

4. Any other trusts that hold other assets where a tax liability has not arisen.

Trusts that do not have to be registered.

While the extension of the TRS requirements covers many trusts that previously didn’t have to register, there are a number that remain exempt. A full list of exemptions can be found on the Government’s ‘register a trust page’ here. Remember, that this only applies if the trust is not liable to UK taxes.

How TaxAgility can help

While you can do this yourself through your own Government Gateway account, it’s really important that you get it right the first time. Mistakes in any reporting to HMRC can be very costly. This is why TaxAgility offers a simple service to ensure your Trust is reported correctly. First, we will make sure your trust isn’t exempt. Then we will ensure the correct information is reported through the TPS service and that it is up to date - another requirement, even if you have previously registered your trust.

Contact TaxAgility today on 020 8108 0090 and enlist our assistance in registering your Trust - time is running out.

All you need to know about transferring a property portfolio into a limited company

If you already have a property portfolio or are considering building one, should you do this in your name or within a company. Also, if you have a portfolio, is it worth transferring it into a company rather than holding it in your own name?

Professional and amateur landlords are finding themselves entering stormy waters. Recent press headlines tell stories of long time landlords with sizable property portfolios considering calling it a day. Why?

Enter Section 24. This has gradually been phased in since 2015, but was in full force by 2020. Section 24 of the Finance Act 2015 restricts mortgage interest relief at whatever tax bracket you found yourself in - say 40%, to the basic rate of 20%. This means that for some BTL landlords, their tax bills have doubled. For some, in higher tax brackets, it’s significantly more.

While Section 24 reduces tax relief on mortgage interest payments, it still allows a raft of other ’operational’ expenses to be set against profits before tax.

Furthermore, recent changes in Section 21 laws mean that landlords can no longer simply evict tenants for ‘no-fault’. This makes renting much more risky.

Naturally, these changes are making many landlords think twice about either continuing with their portfolios or entering the market. However, for those more hardy landlords or still aspiring investors still looking to build a property empire, one incorporating all the legal challenges currently surfacing, this may represent a great opportunity to pick up rentals other landlords are looking to dispose of. The question arises - should a property portfolio be held in an individual’s name or within a corporate entity?

Should I transfer my rental property portfolio in to a company?

Why does this question arise? Quite simply - because of personal tax issues and potential benefits of lower corporation tax.

Landlords who run a property rental business, perhaps built through buy-to-let mortgage schemes, report income from their lettings business in their own personal tax return - the SA100, more specifically the SA105 Supplementary pages. In other words, a landlord could find themselves in a higher tax bracket - 40% or 45%.

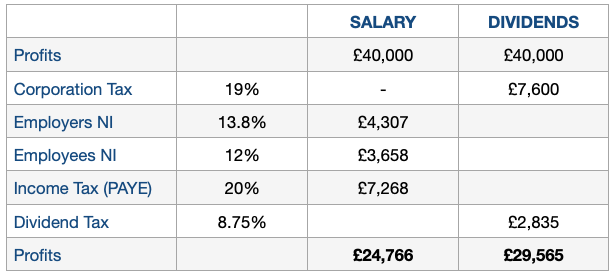

Holding property in a company means paying corporation tax on profits, currently at 19%, rising to 25% in 2023, significantly better that paying 40% or 45%. If a director then takes a dividend to access the profits, they will likely see a sizable positive difference compared to the alternative of a personal tax approach. This is because of the savings made from not paying regular income tax and national insurance.

The director is around £4,800 better off through dividend taking - currently.

Where property portfolios and existing landlords are concerned there is a rather large ‘BUT’ in regard to whether it’s actually worth transferring property into a company to realise gains through paying corporation tax and dividends. This is another key question that gets asked.

Is it worthwhile transferring my property portfolio into a company?

The answer to this question is ‘it depends’. In this case it rather depends on how many properties you have in your portfolio.

To be able to transfer a property into a company, you are essentially selling what you own to the company entity. What does this mean?

- Transferring the property into a company means that you will no longer own the property - the company will. Your ownership is indirect, through shares in your company. If you own 100% of the company, then you own 100% of the shares and therefore the shares in the properties.Problems may arise when trying to do this though, particularly if the properties are mortgaged, such as through a ‘buy-to-let’ (BLT) scheme. The problem comes about because banks won’t allow you to mortgage an asset you don’t personally own. If you do have properties mortgaged, in all likelihood, you’ll have to pay-off the original ‘personal’ mortgages and re-mortgage through a commercial mortgage scheme. Naturally, interest rates will likely be high for commercial loans. If you own the properties outright, this isn’t an issue.

- When you ‘sell’ the property(s) to your company, you’ll likely be liable for capital gains tax (CGT) on any profits you make in the sale. If you’ve had the properties for a while, this may be significant. Naturally, HMRC expects you to sell the property at a realistic market rate, so you can’t step around this by selling the property to your company ‘on the cheap’.It may be possible for you to ‘defer’ the CGT payment. If you run your BLT as a business, as opposed to ‘a source of disposable income’, you may be able to receive ‘Incorporation Relief’. This is more likely to apply to a landlord with more than a few properties though. Incorporation relief allows you to defer the CGT payment until a later date when the shares you receive in return for the properties are divested of. At the time of divesting, you’ll be liable for the CGT you would have paid originally.

- Another consideration to make before shifting your properties into a company is the fact that selling them to your company means your company will have to pay stamp duty too. If for instance, under normal circumstances, the property you are selling sells for £350K, you’ll need to pay around £18,000 in Stamp Duty (SDLT), as you’ll own more than one residential property. If you have a number of such properties to transfer, you may be able to claim ‘multiple dwellings relief’. The benefit in this is that rather than apply SDLT to each property transaction based on the price paid, the purchase of multiple properties is considered as a single transaction. So, rather than calculating SDLT on the total price of all properties purchased, SDLT is calculated based on the average price paid for each property. This is likely to reduce overall SDLT payable.

- There are other costs associated with running a property business, that as an individual, you’ll not pay. You’ll need to use an accountant like TaxAgility to assist with your business tax returns and other statutory requirements. On a monthly basis, you’ll likely need your bookkeeping done so as to keep track of rent payments, and the general costs associated with running a residential property portfolio. All this adds up.

- Please note: While the above implications for CGT and stamp duty apply in most circumstances, mechanisms do exist where it is possible to legitimately avoid both capital gains tax and stamp duty. How this is achieved does depend on your unique circumstances and we would need to discuss this with your directly so that this could assessed and explained in detail.

Call us today on 020 8108 0090 to find out more.

In summary, transferring a property portfolio into a company is not a step that can be taken lightly. All the financial implications with moving a property portfolio into a company suggest that it’s wise to prepare a complete financial model showing before and after projections of any likely cost savings. Remember that any benefit that arises will arise from the longer term tax savings through corporation tax and dividend tax, if you take the profits in that way. When considering the transfer costs identified above, reaching breakeven may take a few years. The scale of your business though, may still make this an attractive proposition.

Moving a property portfolio into a company isn’t straightforward for many portfolio owning landlords, there’s a lot to consider and numbers to work through. Starting a property portfolio though using a company, is a different matter, as all of the costs associated with transferring properties won’t exist, making the decision more attractive to make.

TaxAgility can advise and assist landlords with property portfolios make the right tax choices

Whatever circumstances you find yourself in, we'd like to reassure you that TaxAgility are specialists in assisting landlords and ‘High Net Worth Individuals’ (HNWI) with personal property portfolios, to make the best decisions. We’ll walk through the thinking and the calculations with you transparently, so you can decide if moving a property portfolio into a company is the right thing to do.

No matter what you decide, we’ll be here to help you manage your portfolio in the most tax efficient manner based on your unique circumstances.

Call us today on 020 8108 0090 and find out how we may be able to significantly improve the tax outlook for property letting business.

Please note: The information contained in this article should not be treated as either tax advice or investment advice, it is for information only. You should always contact a tax or investment professional who can assess your personal circumstances before making important financial decisions.