Is The Sales Call Dead or Alive?

When was the last time you received an ‘unsolicited’ sales call? Chances are, as a small business owner, the time period will be measured in a day or less. Ask yourself this though: what happened when you realised it was a sales call? Did you firmly (but politely) ask them not to call you again? Did you put the phone down instantly? You probably weren’t interested, it was inconvenient (or annoying) and you only wanted to keep it short. Stepping back and thinking about what just happened, to both you and the person who made the call, one quickly realises that the reason why so many small business owners are reluctant to make sales call themselves is because of fear of rejection.

When was the last time you received an ‘unsolicited’ sales call? Chances are, as a small business owner, the time period will be measured in a day or less. Ask yourself this though: what happened when you realised it was a sales call? Did you firmly (but politely) ask them not to call you again? Did you put the phone down instantly? You probably weren’t interested, it was inconvenient (or annoying) and you only wanted to keep it short. Stepping back and thinking about what just happened, to both you and the person who made the call, one quickly realises that the reason why so many small business owners are reluctant to make sales call themselves is because of fear of rejection.

As Accountants serving small businesses across London, we have helped many clients to expand and grow their business over the years. For clients who want to target new customers, sales calls are still necessary – in fact, many would say picking up the phone is still a better approach then sending out an unsolicited email. So let’s talk for a moment about sales calls and how to make them work for you.

Don’t make it personal

Let’s set the record straight – when people say no to a sales pitch, they are not rejecting ‘you’ as a person. They just aren’t into buying the product or service you’re selling at this moment.

So take the emotion out of the sale (keep the passion though), don’t appear nervous or too eager. Instead, be clear as to exactly why you are calling. Using a clear and well thought through 15 second ‘elevator pitch’, is often a great starting point. Also, have an organised sales process, one that allows you to identify where you are in the sales cycle and where the potential client is in their thinking, quickly. This allows you to prepare and have the most appropriate responses written down so you come across professionally.

Research first

Spend some time researching your prospects before picking up the phone. If you know exactly how your product or solution will benefit them, work that in to your ‘elevator pitch’ to improve your chances.

No strings attached

Even if you have the most fantastic product or service, business clients today are not likely to buy it right away over the phone, so what can you do to get them interested and want to talk to you further? Many successful entrepreneurs give something out for free without any strings attached, such as a one-to-one tutorial, a white paper, a free trial, things that are useful and have real value to the prospects.

Also, as people like to do their own research, give them your website, company Facebook, or twitter username.

Once you accept that rejection is just ‘parr-for-the-course’ and not personal, you can focus on success and with increasing successful sales calls, get more clients, at which point it may mean that you are ready to expand your business. This is when TaxAgility, as professional business advisors, will sit down with you to look at numbers, advise on growth and assist with tax planning, areas which you can get funding (and how we can help), among other things.

TaxAgility are local London small business accountants, dedicated to making your small business a real success. Give us a call on 020 8780 2349.

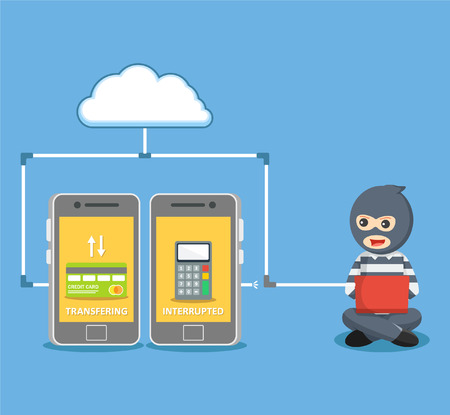

Protect your business from ransomware

The latest ransomware attack which infects more than 300,000 computers in organisations across 150 countries, including the NHS in England, has left people worried about their work and personal computers now.

The latest ransomware attack which infects more than 300,000 computers in organisations across 150 countries, including the NHS in England, has left people worried about their work and personal computers now.

Are you at risk?

Let’s briefly mention what ransomware is – it’s a computer virus which encrypts your files (documents, videos, photos, databases) and won’t release them unless you pay a ransom in the virtual currency Bitcoin and within the time duration given. Tricking you into installing the virus unknowingly from an innocent-looking email is a common way which the virus gets into your computer. Another way is by exploiting a security hole in software on your machine.

Usually ransomware targets machines running Windows operating systems, in both big corporations as well as small companies. Home users are believed to be at lower risk to this particular virus. However, that doesn’t mean you should lower your guard.

There are few immediate steps to protect yourself:

- Backup your files now – on the cloud and offline (like an external hard drive that isn’t connected to the Internet).

- Open and read your email with great care. Do not read any innocent-looking emails that make you pause, like an email titled ‘Lindsey sent you an invoice’ which doesn’t fit into the pattern of Lindsey or your financial practice. Do not click on the links within this type of email.

- Update your Windows operating systems to the latest version, or install the latest patches.

- Install firewalls.

- Install/ update your anti-virus software.

Use Cloud Accounting

Considering the constant threat from ransomware, it’s a good time for small business owners to switch to cloud accounting – which basically means the accounting system is hosted on remote servers, rather than the software in your computer. The two main benefits of cloud accounting for small business owners are:

- It allows you to access your accounts anywhere, as long as you have internet connection.

- It keeps your data safe. You don’t have to waste time/money trying to recover any lost data in your work machine.

To find out more information about cloud accounting and how we can help, visit the post titled ‘Why so many SMEs are switching to cloud accounting’.

Liked this article? Then you may also like “Small business: make cyber security a priority”